Underinsured Motorist Accident Claim Lawyers, GA

Helping Injured Clients Stand Up for Their Rights

All drivers in Georgia are required by law to carry auto insurance for their motor vehicles. Unfortunately, many drivers cut corners and carry only the bare minimum levels of coverage, or worse – no coverage at all. So, what happens when you get involved in an auto accident with an underinsured driver? The attorneys at The Scott Pryor Law Group explain your options when dealing with an underinsured driver. If you have been injured in an accident, call the The Scott Pryor Law Group at 678-325-3434.

What Are the Minimum Auto Insurance Requirements in Georgia?

The minimum liability coverage requirement for drivers in Georgia is what insurance companies refer to as 25/50/25. That means $25,000.00 for bodily injury liability per person, a maximum of $50,000.00 in bodily injury liability per incident, and up to $25,000.00 for property damage per incident. Liability coverage provides payments to third parties injured in an accident with the policyholder and also covers property damages.

These are the legally required minimum insurance coverage limits that Georgia drivers should obtain before being able to operate their motor vehicles on the road. Most insurance companies offer a variety of options for drivers to add more coverage and increase their limits, as the state minimum is often not enough to provide full coverage in the event of a car accident.

What Is an Underinsured Motorist?

An underinsured motorist is someone who carries auto insurance coverage, but their liability insurance coverage is insufficient to cover the total amount of damages resulting from a car accident. This can happen if a motorist has elected to only carry state minimum coverage or even coverage below the state minimum, in some cases.

Many drivers choose to carry bare minimum coverage or below state minimum limits in an effort to save a few pennies on their monthly premiums. However, this is rarely a sensible approach, as not having enough coverage to pay for damages to a third party in the event of an accident can expose an underinsured driver to personal economic losses. In other words, if a person’s auto insurance policy does not fully cover the cost of a car accident, that person could be paying out of pocket for a percentage of the damages.

How Do You Recover Compensation for Damages Caused by an Underinsured Motorist?

Uninsured or underinsured motorist coverage is an optional insurance add-on that provides policyholders with additional protection in case they are injured or have their vehicle damaged by another driver whose policy limits are not enough to cover all damages. While not mandatory, having this type of insurance can be of great value as it allows you to have an easy way to receive payment for your injuries and damaged property when you are hit by an underinsured motorist.

If you have been injured in a car accident caused by an underinsured driver, you have a few different options to recover compensation. First, if you have UIM coverage, you should reach out to your own insurance company to begin the process of filing a personal injury claim. If you do not have UIM coverage, you may want to reach out to a personal injury lawyer as soon as possible to see if you may take your case to the courtroom and initiate a personal injury lawsuit against the underinsured driver or their insurance company.

Is There a Time Limit to File a UIM Claim?

After an accident involving an underinsured motorist, it is crucial to observe any applicable deadlines for filing a claim or taking legal action to recover damages. If you have underinsured motorist coverage, it is best to read your policy to understand how much time you have to file a claim. Regardless, you will want to contact your insurance company right away and report the accident as soon as you can.

If you do not carry UIM coverage and are considering filing a personal injury lawsuit in court, then you should observe the statute of limitations applicable to your case. In Georgia, personal injury plaintiffs have up to two years to take action, counting from the date when the accident took place. Two years may seem like a long time, but waiting that long is almost never a good idea. The longer you wait, the less likely you are to retrieve the necessary evidence to support your case. In addition, if you miss the two-year deadline, your claim may be automatically dismissed because the statute of limitations has expired. Be sure to contact an experienced personal injury attorney shortly after your car accident to maximize your chances of receiving fair compensation.

Why Should I Hire an Attorney for My Case?

Accidents involving an underinsured motorist may not always be easy to navigate, as they may require a lot of back-and-forth communication and negotiation with insurance companies, extensive investigation to determine fault for the car accident, and a lot of work gathering evidence and the documentation needed for a successful claim. In addition, many insurance companies are not willing to offer a prompt resolution to claims and would rather protect their profits by finding ways to deny legitimate claims or pay minimal compensation whenever possible.

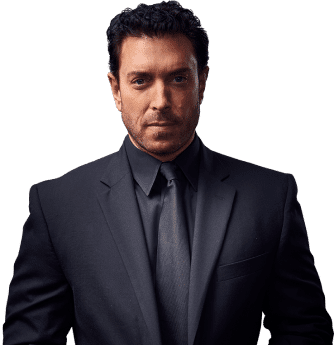

At The Scott Pryor Law Group, our personal injury attorneys are all too familiar with the process of navigating underinsured motorist claims and making sure their clients are treated fairly by the insurance company. We can handle all aspects of your claim for you and are not afraid to go to trial if necessary. Reach out to our law office at 678-325-3434 to discuss your case and learn how we can help you.

6185 Crooked Creek Rd NW Ste. H

6185 Crooked Creek Rd NW Ste. H Se Habla Español

Se Habla Español